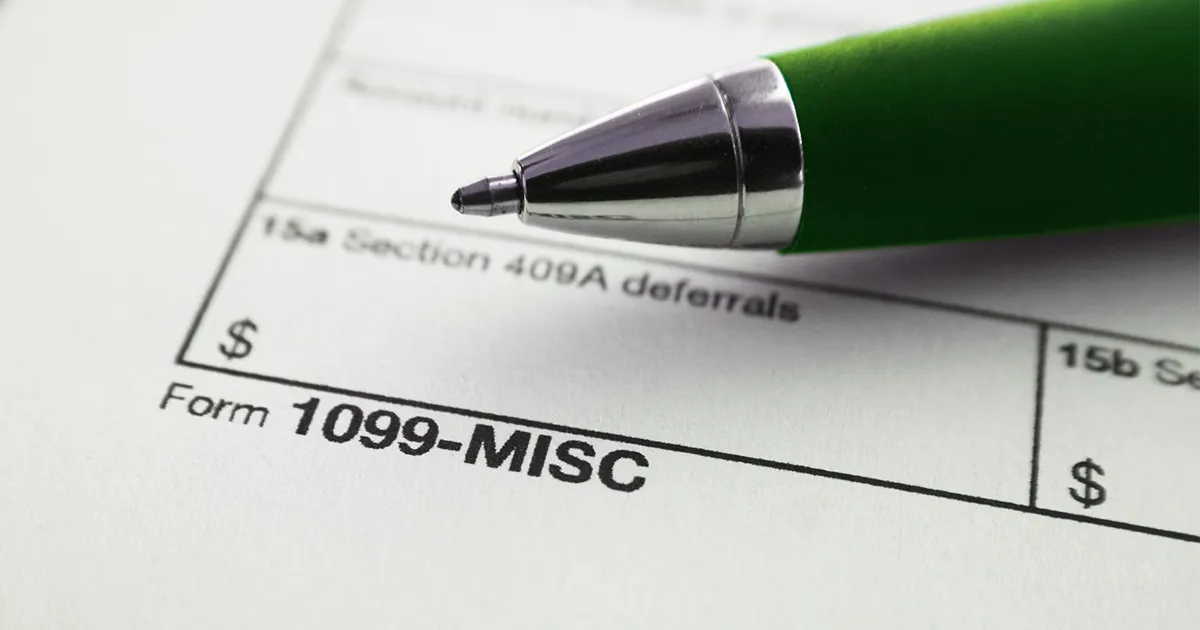

What is Form 1099-K?

Form 1099-K is an information tax document that helps individuals and businesses reports payments received during the previous year from selling goods or services via:- Credit and debit cards

- Stored value cards, aka gift cards

- Online marketplaces (Facebook Marketplace, etc.)

- Other online platforms that manage transactions (Fiverr, etc.)

- Payment apps (PayPal, etc.), referred to as third-party settlement organizations (TPSOs).

1099-K News for 2024

The American Rescue Plan introduced in 2021 famously issued direct payments to American taxpayers to help ride out the impacts of COVID-19. But it also did something else — changed the reporting threshold for business transactions settled using TPSOs. The goal was to require reporting once transactions exceeded $600 (gross), a massive decrease from the previous threshold of 200 transactions or $20,000. Here’s what you need to know: The threshold change is starting to roll out now in 2024. After a multi-year delay due to backlash over this sudden and stark change, the IRS issued Notice 2023-74, which will phase in the threshold change. It will start with a new $5,000 threshold for the 2024 tax year. That said, some states have already switched to a lower threshold. For example, as of 2023, several states instituted the $600 threshold for requiring a 1099-K from TPSOs.Why Should Accountants Be Paying Attention?

Luckily, this is not another form that accountants and bookkeepers have to think about issuing in time (not for themselves, anyway) — but it’s helpful to know what the 1099-K is because you’ll likely receive one as a business that’s received payment via card. Because of the 1099-K, you’ll also find yourself issuing a lot fewer 1099-NEC and 1099-MISC forms on your behalf as well as for your clients. This is because transactions made via credit card or one of the dozens of third-party payment platforms are already reported to the IRS via the 1099-K. Another reason to get to know 1099-Ks is simple: You may find yourself needing to reconcile the data on this form against reported sales income on your clients’ tax returns, and your own. We’ll talk more about this process later in this article. And finally, you should care about Form 1099-K because millions of taxpayers who have never received one before are about to start seeing them for the first time in 2024 and beyond. And they’re going to turn to you for help. Here’s what you need to know to prepare for the increase in paperwork and flood of questions you’re likely to receive from your clients around 1099-Ks.Who Should Send Form 1099-K?

Credit card companies, payment apps, online platforms, and pretty much any entity that processes payments should be sending 1099-Ks to users who meet the threshold. Here’s the full list from the IRS at the time of this writing:- Payment apps

- Online community marketplaces

- Craft or maker marketplaces

- Auction sites

- Car sharing or ride-hailing platforms

- Ticket exchange or resale sites

- Crowdfunding platforms

- Freelance marketplaces

Who Should Get Form 1099-K?

There are two types of clients who should get a 1099-K:- Any individual or business that received payment by card (credit, debit, gift) for the sale of goods or services. There is no threshold here.

- Any individual or business that received payment via a payment app or online marketplace and meets the current reporting threshold. They may include side hustlers, small businesses, crafters, and even casual sellers (more on them shortly).

- Goods sold (including personal items)

- Services provided

- Property rented out

What About Sales of Personal Items?

One of the biggest concerns about considerably lowering the threshold for TPSO reporting is how it may impact people who sell personal items casually through platforms like eBay. Technically, they should only be taxed on these sales if they result in a profit. But profit or not, once a seller meets the reporting threshold, they’re likely to get a 1099-K. If your client received a 1099-K for income that resulted from personal items sold at a loss, here’s how the IRS recommends handling it using Schedule 1 (Form 1040):- Reporting the proceeds from their Form 1099-K on Part I, Line 8z using the description “Form 1099-K Personal Item Sold at a Loss” then

- Reporting costs, (up to but not exceeding the Form 1099-K amount) on Part II, Line 24z with the description “Form 1099-K Personal Item Sold at a Loss”

Where Clients Can Check for 1099-Ks

If a client didn’t receive a 1099-K when they expected to, they can usually go straight to the payment platform to find it. Here’s a quick breakdown of where the document lives on a few popular apps:- PayPal: Dashboard > Activity > Statements > Tax documents

- Stripe: Dashboard > Documents

- Square: Dashboard > Tax Forms

- Amazon Pay: Seller Central Account > Reports > Tax Document Library