1099s

Track and prepare 1099s

Equip your team with tools to identify vendors and collect W-9s all year long, so you can avoid the January-induced headache.

Get started

Trusted by thousands of bookkeepers and accountants

Got 1099 problems?

Identify

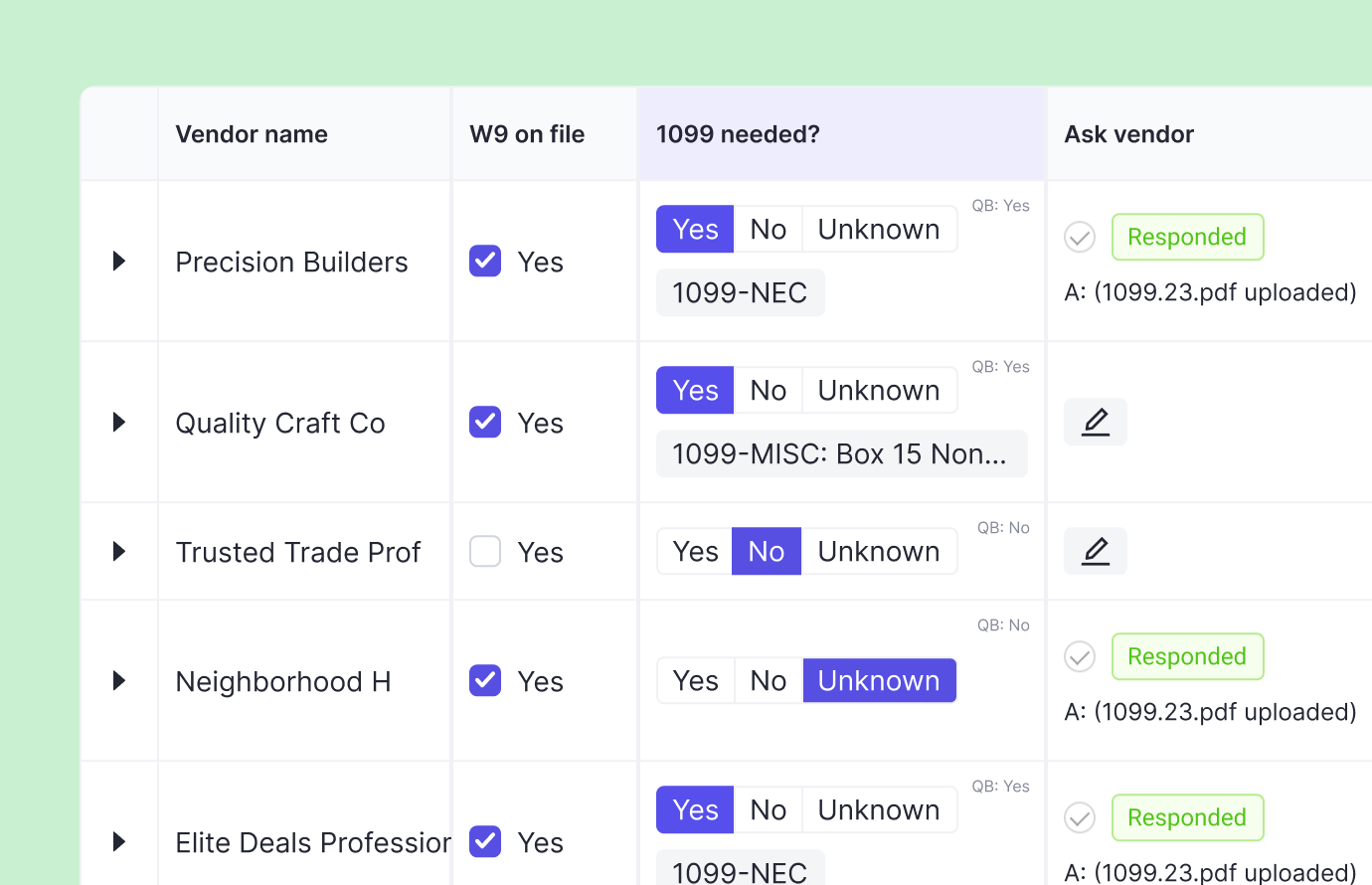

Keeper’s Prepare 1099s Report integrates with your client’s QuickBooks/Xero ledger and identifies vendors that meet the reporting threshold. Credit card transactions are excluded by default.

“It’s so easy to let a client know we need a W-9 and when it comes directly from the vendor, it’s so smooth! Keeper helps us catch missing W-9s immediately. We expect to cut down the amount of time we spend chasing W-9s at the end of the year by two-thirds or more. ”

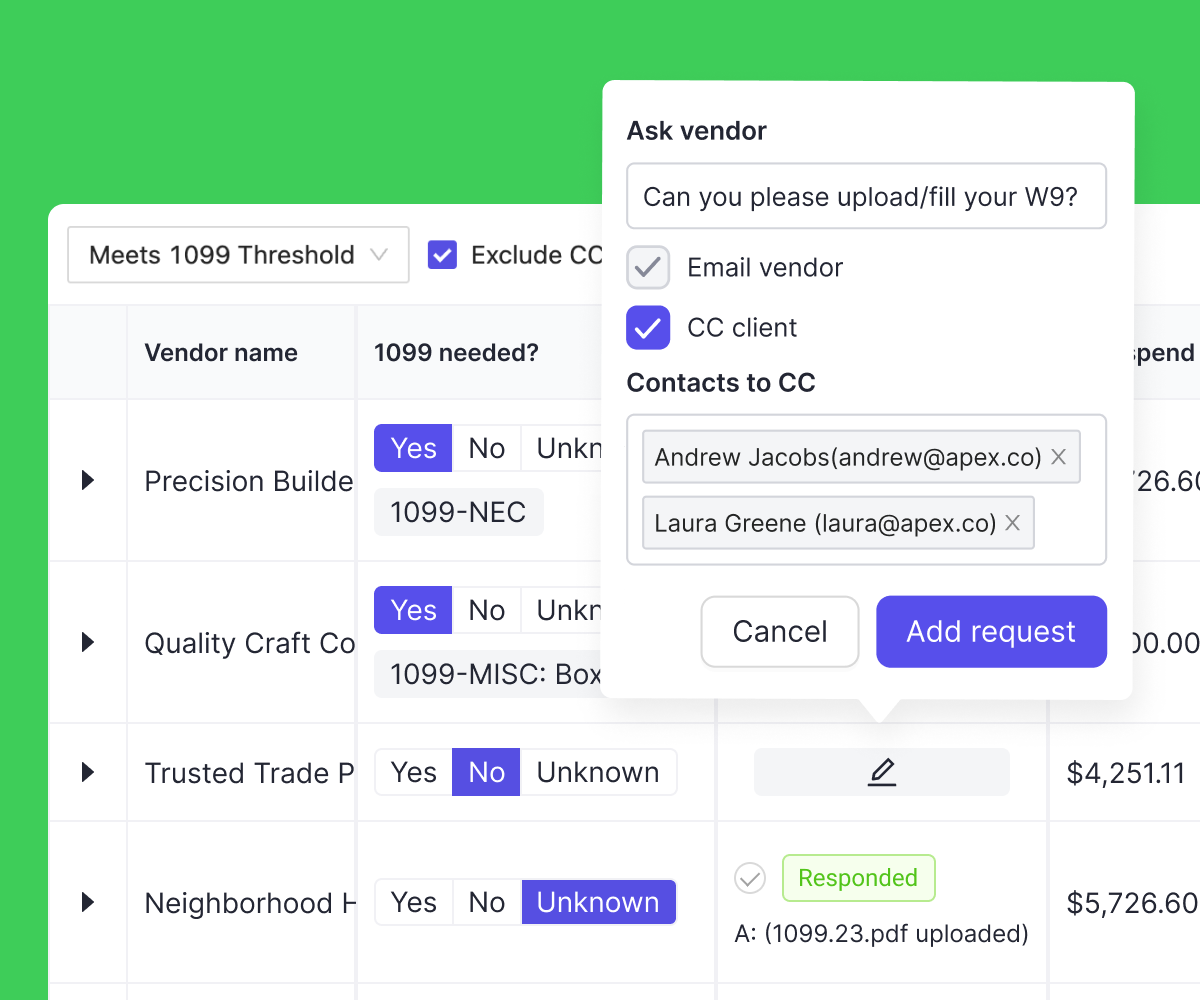

Request

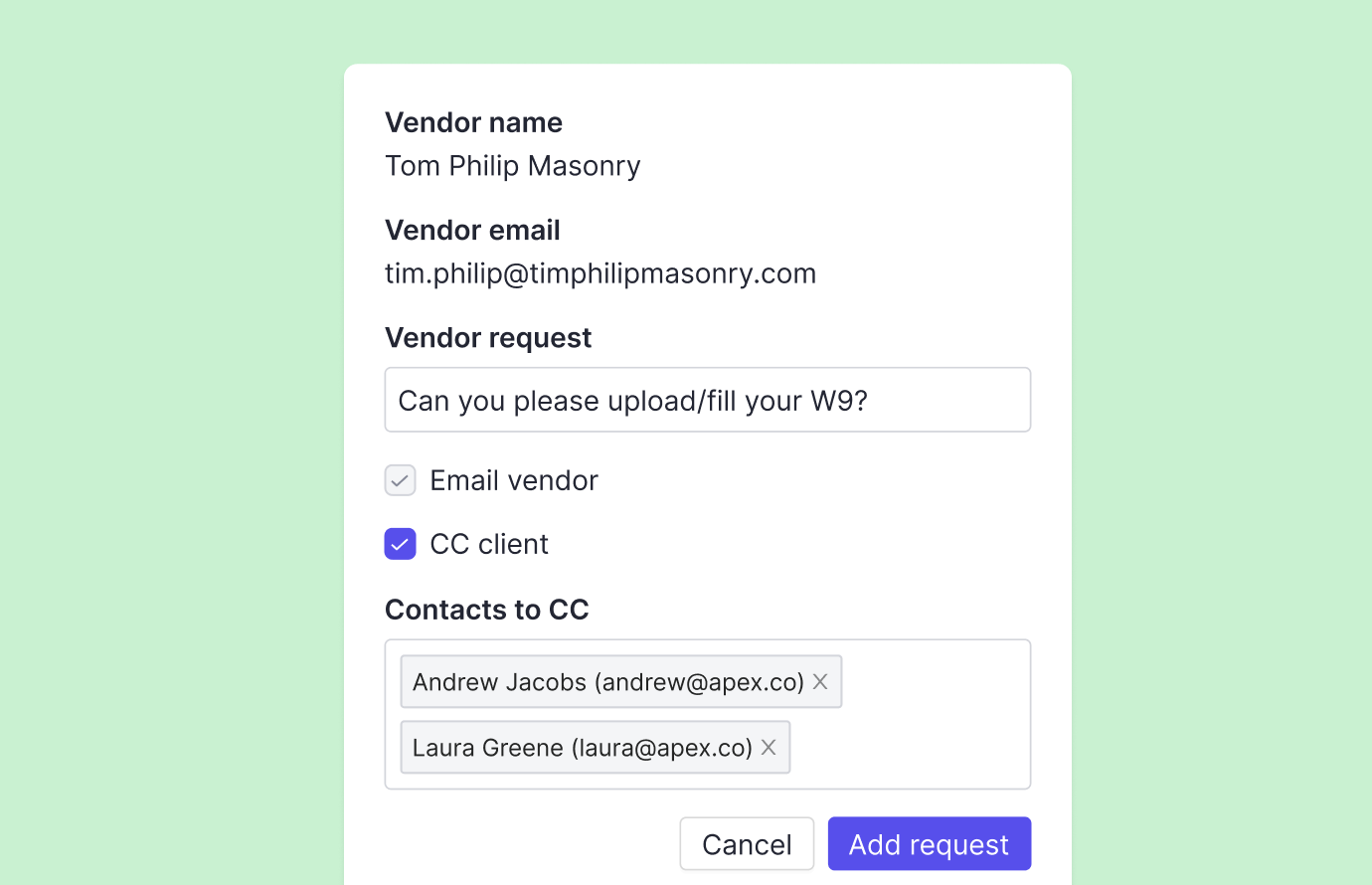

If a 1099-eligible vendor is missing a W-9 – you can use the Client Portal to request it from your clients, or from the vendors directly. Stay on top of W-9 requests all year long and build the task into your monthly workflow, using the newly added vendors report.

Update

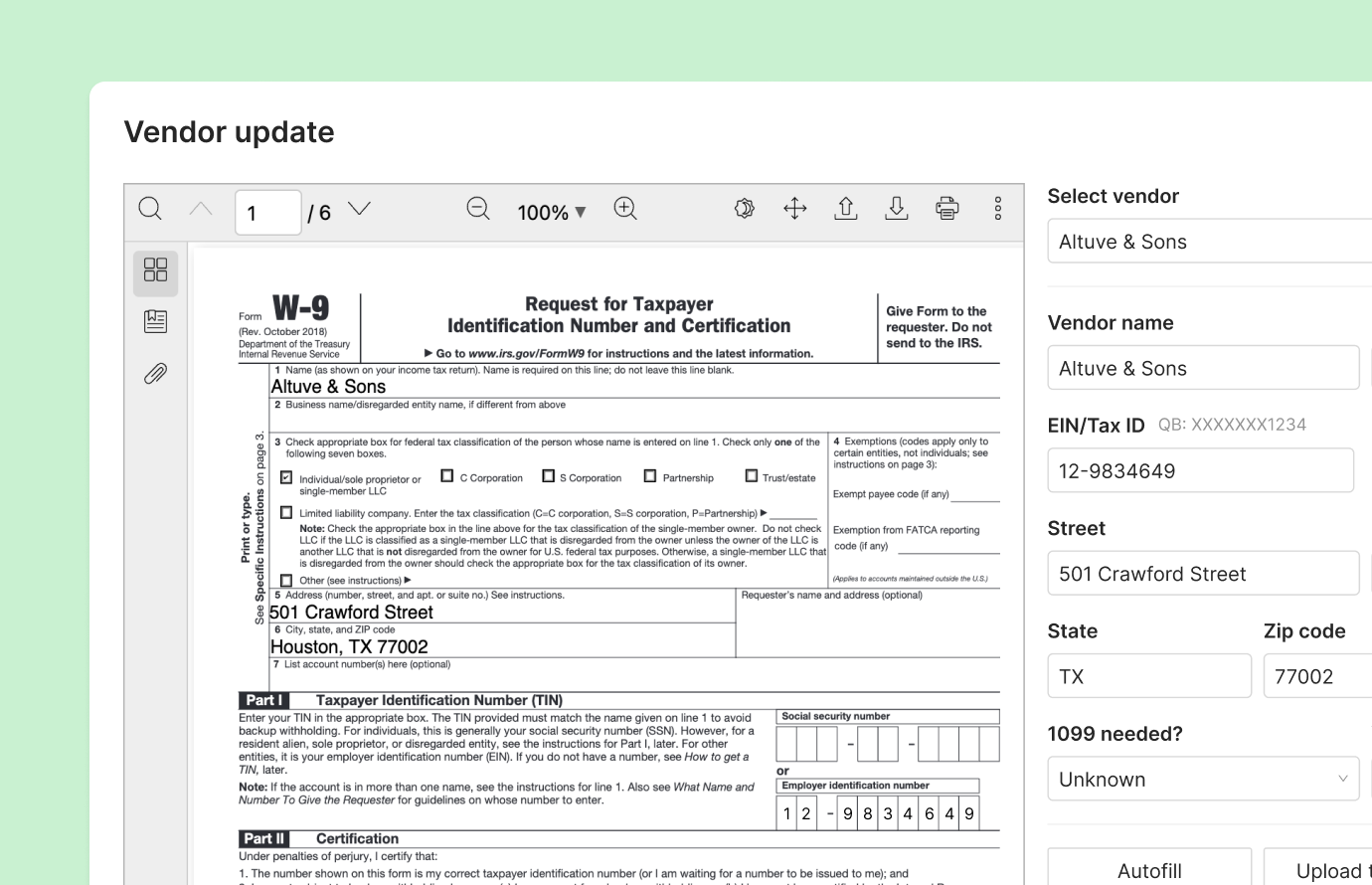

Once the vendor provides a W-9, you can update that data within Keeper and it will sync back to QuickBooks Online and Xero instantly.

Explore File Reviews

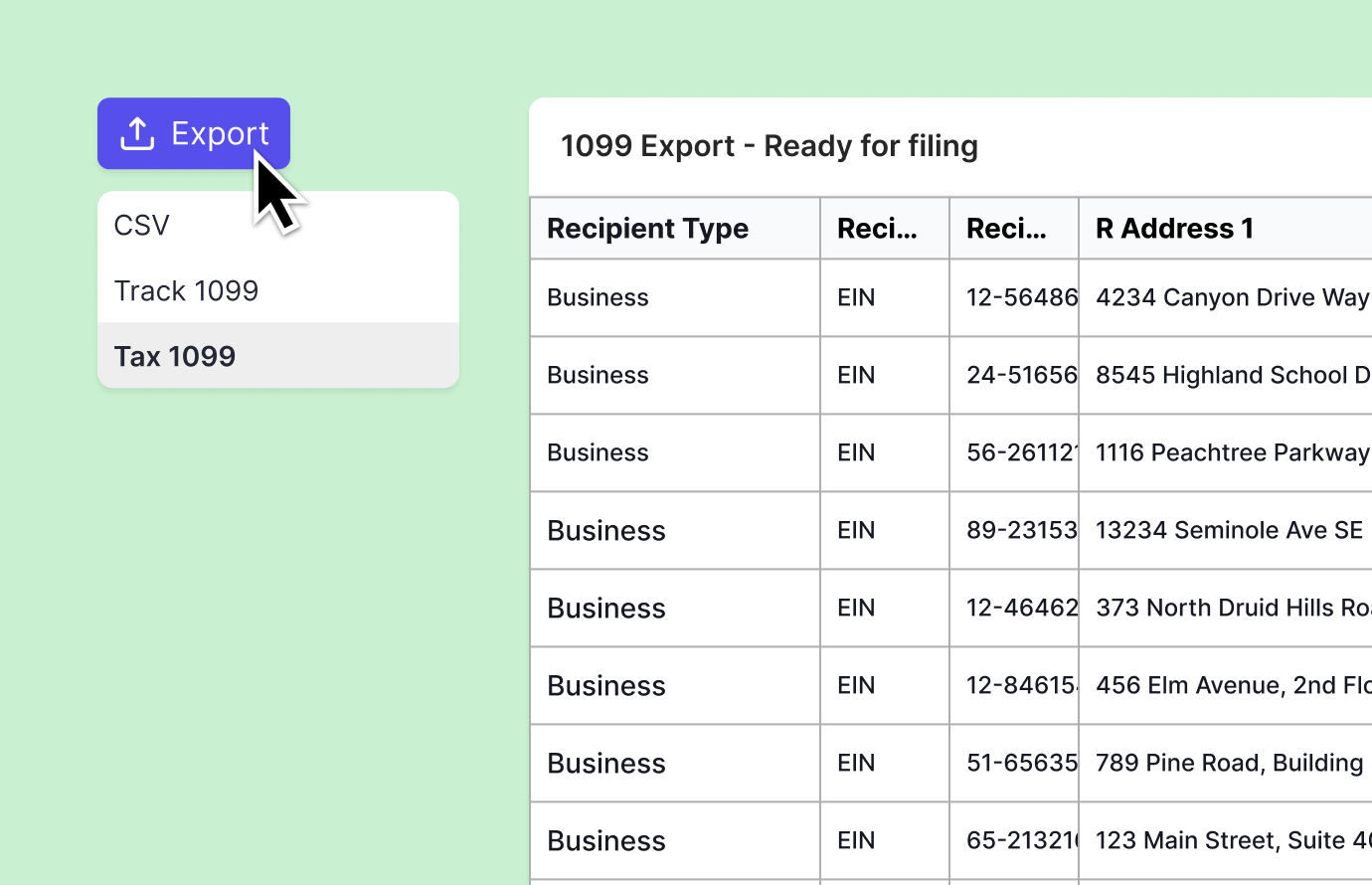

Export

Export all 1099-related data (in your preferred file format) to Track1099 or Tax1099 for filing.