Summary

- Outsourcing, offshoring, and automation will help your firm grow capacity, cut costs, and still meet client demand with high-value outcomes.

- Use an AIOO approach to determine how to offload common accounting tasks.

- Learn how to get started with offshoring, including using practice management software.

Between…

The well-documented accountant shortage.

Downward price pressure.

The need for rapid upskilling as new laws make compliance more complex — and more important.

And of course, the existential fear that’s squeezing every industry: How is artificial intelligence going to disrupt my practice?

…there’s a lot weighing on accountants and bookkeepers today.

While none of us can create more time, we can increase how much we get done in the same amount of time by layering on additional resources.

However, we usually don’t need the same amount of resources every season — and who could afford to hire all the support they actually need, anyway?!

In 2024 (and beyond), it’s time to take an outside-the-box, yet proven, approach to overcoming capacity constraints.

Understanding Outsourcing, Offshoring, and Automation

Outsourcing is something most people are familiar with, even if they don’t use that particular name for it. It’s simply the practice of delegating — or handing over certain tasks to another firm or individual who has more capacity, specialized expertise, or both. Plenty of service providers keep a roster of “partners” to whom they outsource jobs on the backend so that they can give clients a holistic-feeling experience on the frontend.

Offshoring just expands on this idea by contracting an overseas firm to help your team. It’s a great way to grow capacity during busy seasons and increase your range of services without burning out your core team.

Nearshoring is a form of offshoring where the outside provider is a little closer to home — such as in a neighboring country. This can help you work together more closely as you’ll be more likely to share a time zone and maybe even a common language.

And there’s one more, though not quite as popular: Onshoring. This is the practice of outsourcing tasks to a third-party in the same country you’re in. However, it may be in another state and is often in a smaller city, where you’re able to find firms with higher availability and lower rates.

Finally, there’s accounting Automation, which is the practice of applying technology instead of additional people to help you get more done in less time.

Accounting automation tools and AI are helping firms handle the manual elements of the job, such as data entry, reconciliation, document and receipt management, elements of tax preparation, and even the simpler, repetitive customer questions you may get!

All of these options may leave you wondering: Where can I automate, when should I engage an offshore or outsourced partner, and what would be best to keep in-house?

The AIOO Approach to Offloading Accounting Tasks

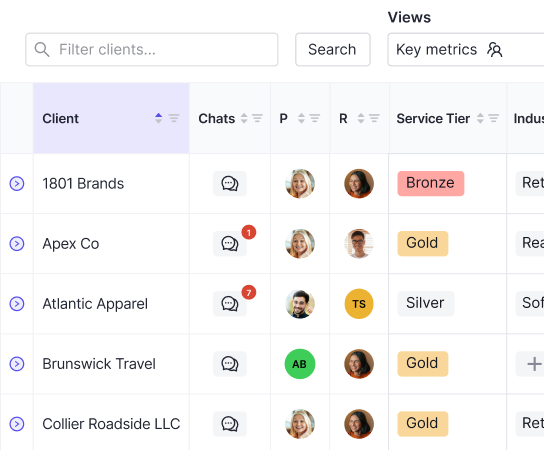

Take a look at the workflow we chatted about with Taxplow founder and author of the Accountants In Front of AI newsletter, Marc Howard.

Called the “AIOO approach,” it’s a simple guide to help bookkeepers and accountants determine how to best handle the growing list of tasks clients come to them with:

- Automate tasks that are repetitive and require consistent execution, without much variation. For example, coding transactions.

- In-house tasks are high-value and require specialized expertise, or have high-to-medium complexity. Financial analysis and forecasting fits into this bucket in most cases.

- Outsource high-value tasks that aren't core to your business, especially if they would be better executed by specialized external entities — such as financial audits.

- Offshore those more routine and standardized tasks that don't require specialized expertise and can be executed at a lower cost in different locations. Think AP and AR management.

AIOO In Action: A Real-Life Breakdown

While this is not an exhaustive list, we broke down many of the tasks that your firm is most likely touching, most weeks. Hopefully, this will help you start thinking through your own specific service offering, where you can niche down to provide the most impactful outcomes for clients, and what you should consider automating, offshoring, or outsourcing to protect your time and sanity.

Bookkeeping and Accounting Tasks

- Coding transactions: automate/offshore

- Bank and transaction reconciliation: automate/offshore

- Document management (receipt management): automate

- Account payable and account receivable management: automate/offshore

- Paying invoices for clients: offshore

- 1099 management: automate

- Month-end close and financial statement prep (income statements, balance sheets): in-house

- Financial analysis and forecasting: in-house

- Customer support (triage and simple tasks): automate/offshore

- Cleaning up books: offshore/outsource

- Financial audits: in-house/outsource

Tax Planning and Preparation Tasks

- Sales tax: automate/offshore

- State and income tax: automate/offshore

- Tax prep: automate/offshore

- Estate planning: in-house/outsource

- Nonprofit and foundation tax planning: in-house/outsource

- Advanced tax planning: in-house

- Entity structure review: in-house

Payroll Tasks

- Federal, state, local payroll tax submission: automate

- Payroll tracking: automate

- Direct deposit services: automate

- Payroll reporting: automate/offshore

Client Advisory Services

Lots of firms dream of shifting to a focus on high-value client advisory services, which they would of course want to keep in-house. Yet, less than 30% of firms are actually able to do it.

Why? Lack of resources.

Accountants and bookkeepers don’t want to drop all the other tasks, many of which are listed above, that keep the lights on while they transition into an advisory role. This highlights the critical nature of employing outsourcing, offshoring, and automation to free up as many as 1,250 hours yearly for you to spend on much higher-impact and higher-value advisory work.

How to Start Offshoring and Outsourcing

Offshoring and outsourcing can bring numerous benefits: cost savings, access to global talent, increased productivity, and more free time so that you can focus on the services that really solve your client’s biggest pain points.

But getting started successfully requires careful planning and consideration. Here are some essential tips to help accounting and bookkeeping firms navigate the process effectively.

Get All Your Client Information Organized Ahead of Time

Before diving into offloading tasks onto other firms, it's crucial to ensure that all client information — data, contact details, paperwork, etc. — is well-organized and readily-accessible.

Keeper’s bookkeeping practice management software can help facilitate a smooth transition and foster a productive relationship with your outsourcing partner.

That’s because Keeper features a branded Client Portal where you can host all client communications as well as internal collaboration. Keeper can also track your practice’s tasks, files, templates, and client information via a built-in CRM. Our automated 1099 management and receipt processing features also streamlined these resource-intensive workflows to make the load lighter on your outside partner of choice.

Determine Where You Need Help

You also want to assess your staff's workload and capabilities as well as use the AIOO method to identify which tasks you’re already doing that are suitable for outsourcing and offshoring.

Focus on areas where an external team can provide the most significant impact, such as time-consuming but simpler tasks, to allow your in-house team to focus on high-value activities and client advisory services.

Find Your Reliable Offshore/Outsourcing Partner

Choosing the right partner is of course paramount to the success of your offloading initiatives. How do you determine a good fit? Here are the key factors to consider:

- Time in the industry

- Technological capabilities — they’ll need some tooling and technical prowess to be able to work with you remotely

- Expertise in various accounting services, especially those you are considering offloading

- Their ability to scale their own team as your needs grow — and how much it will cost you to level up

- A communication style and schedule that aligns with your onshore team

- Client reviews and testimonials (like this one for our friends at TeamUp — wow!)

Learn how to future-proof your firm, deliver on client demands, and more:

Watch our webinar with Isaac Smith, founder of the offshoring accounting firm TeamUp.

Set Up Account Managers, On Both Sides

A responsible, reliable point of contact within both firms is crucial for maintaining a successful relationship.

Account managers will be in change of things like:

- Overseeing hiring, onboarding, and training

- Managing any IT setup that needs to happen

- Assisting with capacity planning

- Arranging regular communication

- Translating and solving questions and feedback

- Dispatching progress reports

- Providing deliverables

Ensure Data Safety

Data security and confidentiality should be top priorities when selecting an accounting outsourcing partner.

Take some serious time to inquire about a potential partner’s data protection measures, encryption protocols, and compliance with industry regulations. Additionally, discuss legal agreements and confidentiality clauses that safeguard your firm and clients in case of any data breaches or mishaps.

Develop Service Level Agreements

Establishing service level agreements (SLAs) with your new third-party provider is essential to set expectations regarding the quality of work, response times, communication channels, and performance metrics.

A well-defined SLA ensures accountability and transparency throughout the offshoring engagement, fostering a mutually beneficial relationship.

Let’s Break the Constraints Together

As you embark on your journey to leverage offshoring, outsourcing, and even automation effectively, remember that strategic planning to choose and work with the right tools and partners is key to unlocking the full potential of these solutions.

Implement the AIOO approach and adopt pro bookkeeping software to prepare yourself for engaging third-party providers to elevate your firm's capabilities, increase productivity, and focus on delivering exceptional value to your clients.