Christina Springstead has had a lifelong knack for numbers. After taking an accounting class in high school and joining Business Professionals of America, it was clear which path she would take after graduation. However, after two semesters into her accounting degree, Christina pivoted to study sports management as she believed it would be more exciting. Ultimately, all roads led back to accounting as she launched her bookkeeping side business in tandem with her full-time career, to ensure she could provide for her daughter as a single mom.

In 2020, the time had come for Christina to focus all her efforts on running her bookkeeping business, Springstead Solutions. Simultaneously, COVID-19 presented a need for businesses to update and organize their books in order to apply for relief loans. Drawing from her experiences in accounting, management of a brick-and-mortar business, and participation in the Profit First program (PFP), Christina identified the true impact disorganized accounting systems had on small businesses.

“So many businesses’ books were messy, which led to them making bad business decisions. That’s where I found my passion.”

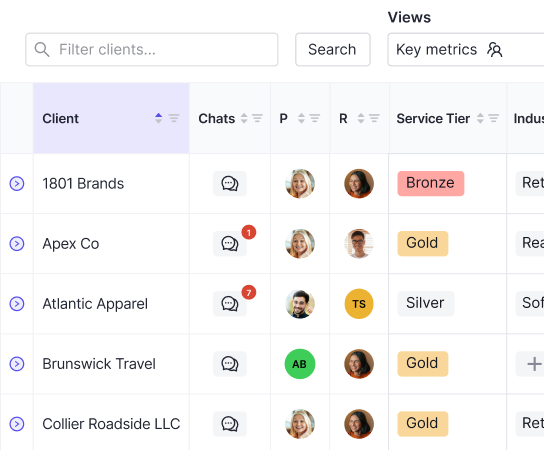

That passion was recognized and appreciated by a growing book of clients, which brought with it a need for an additional employee and new processes. As a self-proclaimed “deep-dive software user,” Christina was not afraid to test out tools to organize her practice. At first, she relied on a workflow platform to track daily tasks, QuickBooks Online to manage and reconcile accounts, a spreadsheet to review the monthly close process, and Keeper for final quality-control checks. These spread out procedures caused Springstead Solution’s rapid growth to seem daunting rather than exciting.

“Before diving into Keeper, our process was made up of many changing systems and a lot of wasted time flipping between tabs and tools, with no single source of truth for oversight of operations,” said Christina. “We were always running into the new month scrambling to get things done and books closed out.”

After scheduling a call with Keeper to answer some lingering feature-related questions, Christina took the initiative to coordinate a collaborative work group with her Customer Success Manager and her fellow PFP peers to determine the best use of Keeper for bookkeeping firms. As a result of those interactions, she made use of what she learned throughout those weeks in order to do her own software “deep-dive,” and was amazed by the results.

“I built out 20 different templates based on our work strategies. I tested, retested, and tested them again. It worked, and the transformation was overnight. From the moment I showed it to my staff, I had more hope in my business than I had in months,” said Christina. “With the ease of Keeper, I actually had oversight of what was happening for all of my clients.”

Springstead Solutions found a powerful way to condense their month-end close process, all in Keeper. And more than cutting down on extra clicks each day, Keeper reduced the actual time spent closing their clients’ books; to the tune of roughly 10 working days per month.

“When we started completing our month-end closes in Keeper, we had more than half of our client work finished by the 12th of the month. Previously, that was not the case – we would often spend up to the 25th of the month getting these tasks finished.”

This newly freed up time was historically spent tracking specific client workflows and drudging through tedious and manual bookkeeping processes – while simultaneously researching, testing, and seeking out better systems. Now, Christina was fully invested in Keeper’s various tools, and decided to go further by switching and subscribing to Keeper Receipts.

Springstead Solutions’ tech stack was effectively and intuitively condensed. “I just need QuickBooks and Keeper – and almost minimally QuickBooks – at this point in time.” Christina recognized this as the perfect time to scale her business.

“With Keeper, we didn’t need more employees, but we could bring on more clients. The amount of time I’ve saved in the last five weeks has been so immense that my client success manager told me she needed more work to fill her plate,” said Christina.

Christina took advantage of this additional time by adding extra TLC to her website and business operations. She revamped her pricing calculator, updated her health check template, and held a few discovery calls with prospective clients.

“I have been able to work on my business instead of in my business because I know the month-end close has been taken care of,” Christina said. “I was even able to move up a discovery call appointment because it was important to the prospective client. In my first 28 days on Keeper, I’ve been able to sign 3 new clients.”

“Hands down, the best decision you will make is using Keeper to its full potential for streamlining your operations. I love it.”

Springstead Solutions is just getting started, and the team is identifying new areas to scale and build out by leveraging Keeper to manage the practice. Looking ahead, Christina is eager to build out new financial tools, improve her branding, and engage in discovery calls with clients to find true alignment.

“I can now have a clear mind to actually go through and understand the work that needs to be done each month. Our books have always been clean, but now they’re sparkly clean.”